Think for a moment about the complexity of designing a car. Over 30,000 individual parts are present in a typical vehicle and the design engineer needs to use all of these parts to create a product that not only meets all stringent regulations, but also meets all efficiency and reliability requirements, looks good, and can be produced millions of times with as few recalls as possible with zero tolerance for accident-causing faults.

The level of technological sophistication embedded into vehicles also continues to grow. An increasing number of sensors and significantly more computing power is enabling more advanced safety features. Layered on top of this are the entertainment and other customer experience features that need to be included and considered.

The car is an extremely complex system, as is the manufacturing process that creates it, and both are prone to unforeseen system interactions and errors. The cost of not finding these errors before millions are copied is high to say the least.

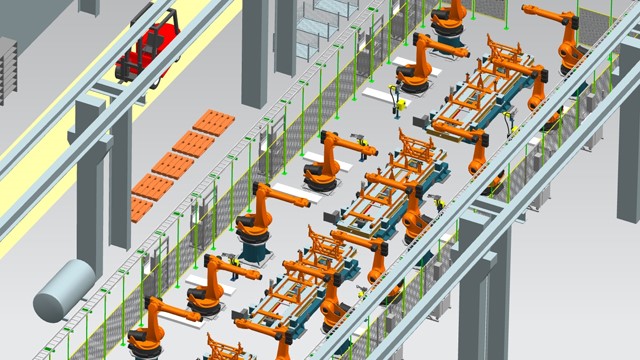

Siemens software includes software to fully design and optimise manufacturing production lines in a virtual environment. Source: https://www.plm.automation.siemens.com/global/en/industries/automotive-transportation/factory-layout-line-design-optimization.html

Siemens software includes software to fully design and optimise manufacturing production lines in a virtual environment. Source: https://www.plm.automation.siemens.com/global/en/industries/automotive-transportation/factory-layout-line-design-optimization.html

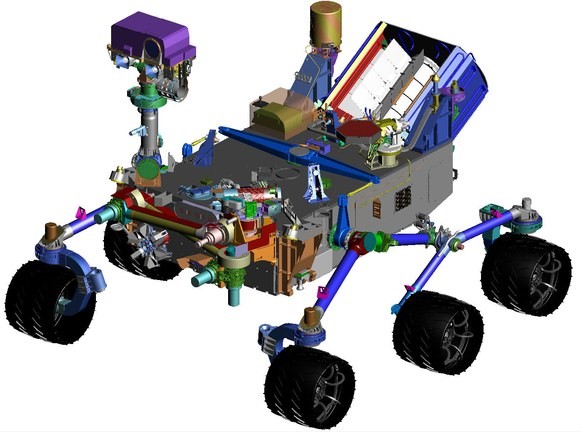

To deal with this massive complexity automakers rely on software tools. Automakers are most commonly using tools provided by Siemens, as are many other types of manufacturers ranging from drone designers, jet engine makers, machine builders, and even consumer electronics companies.

The software that Siemens provides is effectively the platform on which a large part of global manufacturing operates, and it covers the process from conception to design and simulation, along with plant design and infield tracking. They are indispensable.

Their position as a platform also enables them to bring additional capabilities to their customers through acquisitions and offer even greater value. Using software to deal with the complexity facing global manufacturers and their supply chains is far from being fully exploited, and we will eventually get to the goal of complete digitisation of the life cycle of the manufactured product.

Siemens calls their industrial software business “Siemens PLM”. It sits within their Digital Industries segment, which historically and unfortunately has been part of a much larger conglomerate with some good and bad parts. Management, to their credit, has recognised that the sprawling structure they inherited was not optimal and have been simplifying it over the years.

Today they are still involved in a range of other areas including making trains, providing gas turbines for electricity production, equipment for refining plants, supplying electrical components for grids, and providing imaging and diagnostic equipment for hospitals. This has had, and continues to have, a depressing effect on Siemens’ valuation.

Siemens software includes software to fully design and optimise manufacturing production lines in a virtual environment.

Source: https://www.plm.automation.siemens.com/global/en/industries/automotive-transportation/factory-layout-line-design-optimization.html

The software business has been relatively hidden within the group structure but has now become big enough that we think it accounts for at least a quarter of the value of the whole company. As part of the company’s simplification strategy they have listed two of their businesses – their healthcare and renewables businesses – and if you take the value of these two listed businesses out of Siemens, we believe Siemens PLM is worth more than 50% of the rest.

Management have also recently announced their intention to spin off their least attractive businesses in electricity production and high voltage grid products. Once this is complete the “core” of Siemens (which strips out their listed investments) will become dominated by software.

Our outlook is that the current low valuation will grind up, especially as further simplification actions occur overtime. This process will take a few years, but the rewards are high enough to wait. The Perpetual Equity Investment Company Limited (ASX:PIC) is going to get closer and closer to owning one of the world’s greatest industrial assets and a major beneficiary of ongoing digitisation at the heart of productivity improvements. We will be able to do this at a steep discount by taking advantage of the market’s lack of patience.

PIC has increased its position in Siemens with the investment representing 1.1% of PIC’s portfolio as at 31 May 2019.