1H22 Summary:

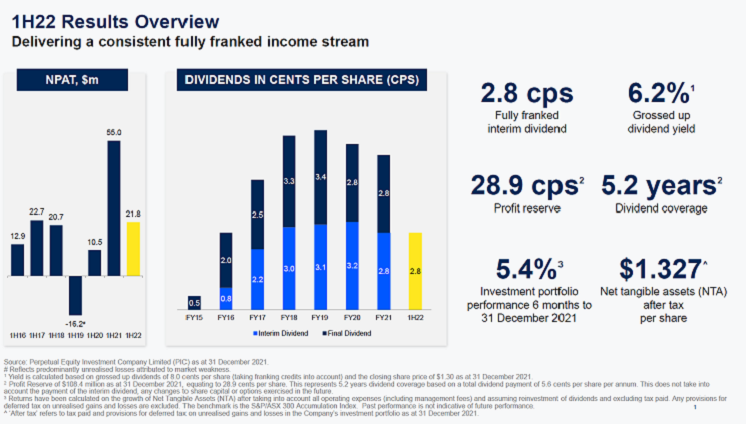

- Net operating profit after tax of $21.8 million

- A fully franked interim dividend of 2.8 cents per share

- Annual dividend yield of 4.3% and a grossed up dividend yield of 6.2% [1]

- Profit reserve of $108.4 million, equating to 5.2 years dividend coverage 2

- Investment portfolio performance for the six months to 31 December 2021 was 5.4% 3 , outperforming the benchmark by 1.4%

The Perpetual Equity Investment Company Limited (ASX:PIC; the Company) has announced an operating profit before tax of $27.9 million and an operating profit after tax of $21.8 million for the six months to 31 December 2021. This contributed to a strong profit reserve of $108.4 million which positions the Company well for future growth.

The Board has declared a fully franked interim dividend of 2.8 cents per share, consistent with the FY21 final dividend, which equates to an annual dividend yield of 4.3% and a grossed up dividend yield of 6.2%1. The dividend reinvestment plan (DRP) is available to shareholders for the interim dividend.

Commenting on the half year performance, Chairman, Nancy Fox said, “The Company continues its upward trajectory, having delivered investment outperformance over the period, while also building its profit reserve and franking account.

For our shareholders, we are pleased to declare an interim dividend of 2.8 cents per share and are confident that the growth of the profit reserve will continue to strengthen the Company’s ability to deliver a sustainable income stream.

We would like to thank our shareholders for their ongoing support and continued confidence in both our effective management of capital and the Manager’s proven ability to navigate various market cycles.”

Shareholders are reminded that last year, the Company announced a one-for-one issue of bonus options which provides holders with the opportunity to acquire a PIC ordinary share for $1.35 (exercise price) per option before the expiry date of 2 September 2022. The options are trading on the ASX under the ASX code PICOA.

The options provide shareholders with the opportunity to purchase additional shares and participate in the potential growth of the Company without incurring brokerage or transaction costs. Option holders that elect to exercise some or all of their PIC options before the ex-date will also be entitled to the interim dividend.

PIC performance and market conditions

The PIC portfolio delivered a return of 5.4%3 for the six months to 31 December 2021, outperforming the benchmark by 1.4%. Over the 12 months to 31 December 2021, the PIC portfolio returned 23.4%, outperforming the benchmark by 5.8%3.

PIC Portfolio Manager Vince Pezzullo said, “We were afforded numerous opportunities amid the COVID-19 led volatility and subsequent market recovery and have delivered strong performance during this challenging period. Markets have now transitioned to a period we believe most investors have never experienced before with inflation risks, looming prospects of yield curve movements, changes in global commerce and businesses being forced to pivot in their supply chains, current carbon footprint and future way of working.

We believe these factors create opportunities to generate positive investment performance against the benchmark and are confident in our ability to navigate these fast evolving market conditions. Our strategy provides a breath of investment opportunity across Australian and global stocks and allows us to invest with high conviction based on our in-depth research.”

As at 31 December 2021, the portfolio held 76.4% in Australian listed securities, 19.4% in global listed securities and 4.2% in cash.

View the Interim Financial Report

Footnotes:

[1] Yield is calculated based on the total dividends of 5.6 cents per share and the closing share price of $1.30 as at 31 December 2021. Grossed up yield takes into account franking credits at a tax rate of 30%.

[2] Profit Reserve of $108.4 million as at 31 December 2021, equating to 28.9 cents per share. This represents 5.2 years dividend coverage based on a total dividend payment of 5.6 cents per share per annum. This does not take into account the payment of the interim dividend, any changes to share capital or options exercised in the future.

[3] Returns have been calculated on the growth of Net Tangible Assets (NTA) after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. The benchmark is the S&P/ASX 300 Accumulation Index. Past performance is not indicative of future performance.