Listed investment companies are one option to explore, offering exposure to a portfolio of securities and the expertise of a professional investment manager through a single trade. LIC’s can also offer exposure and expertise that is difficult to replicate yourself. For example, deep investment research expertise and access to Company boards and management, exposure to global securities, and the time and focus to actively manage the portfolio and take advantage of market opportunities.

At Perpetual, we believe in the benefits of active management, underpinned by deep investment research. As manager of the Perpetual Equity Investment Company (PIC) which can invest up to 25% in global securities, research and understanding of overseas markets is critical.

In November 2019, as the market was making new highs on a daily basis both in Australia and in the US, I embarked on a research trip to the UK with one of my colleagues from the Perpetual Equities Investment team. We spent five jam packed days visiting over 25 companies across 6 sectors. The trip highlighted several investment opportunities and provided an excellent source of information on the state of the UK economy and the impact of the election outcome, which we now know was a landslide victory for Brexit, Boris and the Tories.

Some of our key observations include:

- Numerous quality businesses in the UK have been sold down and trade at attractive discounts to both their own historic valuations and compared to their Australian peers (many who have similar business models). There is a clear value opportunity in the market.

- Discounts to valuations are partly due to uncertainty around the future in relation to Brexit in general and the election. Whilst the impact of the election results was uncertain at the time of our trip, we noted that much of the worst-case scenario was already priced into stock prices.

- Going into the election, both sides of politics were promising large fiscal spending programs after nearly a decade of austerity. Our findings in the UK are that this spending is warranted, especially in the regions like the north which have suffered badly from austerity and would help to boost GDP.

- The private sector is sitting on a lot of cash. We found small and medium enterprises (SMEs) have large cash reserves and are waiting to deploy them once the political environment stabilises. Again, this bodes well for economic growth.

All of this left us with the view that the UK, which already has low unemployment (around 3.8%) and steady growth, is likely poised for a rebound even more so now the election impact is known and favourable. However, this rebound is not priced into equities.

This is where active management comes in, taking advantage of market opportunities as they arise. Based on the findings from our trip we took out some new global listed securities positions in the PIC portfolio. Some stocks we think represent excellent value and are most likely to benefit from the trends above include:

- Lloyds Banking Group (LLOY:LON): The well-known financial services business has survived centuries and trades at just 8.5x earnings - approximately half the multiple of Commonwealth Bank. Lloyds is one of the big four banks in the UK and is the largest UK mortgage player with 19% market share. They are very tactical in writing new mortgage business, have a solid focus on the SME market and strong free cash flow yield.

- Close Brothers (CBG:LON): Another high quality “stalwart” financial services business which has seen multiple cycles but has de-rated alongside other UK financials. Close Brothers has the lowest leverage in the sector and a growing asset management and securities business which is likely to offset yield pressure elsewhere in the business.

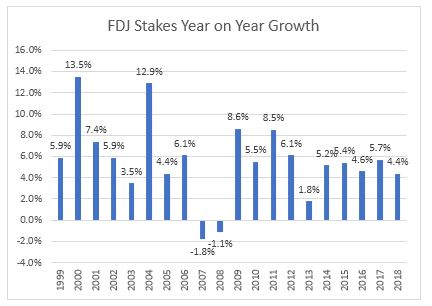

We also recently participated in the Initial Public Offering (IPO) of La Francaise Des Jeux Same (FDJ:PAR), a French Listed lottery and sports betting operator that has, up until the IPO, been owned and operated by the French Government. FDJ holds a highly attractive 25-year monopoly license to operate the French lotteries and has a 45% market share in the French sports-betting market including the exclusive license to operate off-line sports-betting (also 25 years). Whilst sports-betting is a high growth division for FDJ, 85% of group earnings are derived from the lotteries business which is core to our investment thesis. Analysis of FDJ’s lotteries business, shows a similar profile to Tabcorp’s (TAH:ASX) with consistent growth in total ticket sales over a long period of time translating to earnings growth and strong cash flow conversion which we expect to continue moving forward.

FDJ Stakes Year on Year Growth

Source: FDJ Prospectus 2019

Source: FDJ Prospectus 2019

One of the major attractions of FDJ is the potential for earnings growth if the business can increase its digital penetration in lotteries. Sales through the digital channel are at a higher margin for a lottery operator when compared to sales through the retail channel where the operator is required to pay an agent a commission on the sale. Further to this, due to the requirement for online players to register with the lottery operator, the operators can get closer to the customer and better understand customer behaviour and purchasing patterns which can improve marketing efficiency. Based on the Manager’s estimates, FDJ’s online sales accounted for only 2-3% of total sales in FY19. This compares to global peers who index at materially higher levels, as per below.

- Tabcorp – 26%

- Sisal (Italian lottery) – 10%

- Camelot (UK lottery) – 24%

- Norsk Tipping (Norway lottery) – 53%

In preparation for a strategic push to increase the digital penetration, FDJ has invested €250m over 2015-2020 in upgrading its proprietary technology stack and launching new apps and websites. We believe this investment, the structural shift in consumer behaviour to online and the strategic focus of the management team will result in improved digital penetration, margin expansion and earnings growth over time.

On listing, FDJ was priced at an attractive 19.5x FY19 Price to Earnings Multiple (P/E) and a 4.1% dividend yield with a net cash balance sheet. We believe the business is undervalued at this price given the infrastructure like qualities of the asset and the upside opportunity from improving digital penetration.